Pinewoods Hill Eco Solution

Energy Upgrade Support for Multi-Unit Buildings

For Multi-Unit & Rental Properties

Energy Upgrade Support for Multi-Unit Buildings

Energy upgrades in multi-unit and rental buildings require a different approach than single-family homes. We support property managers, ownership groups, and boards by helping them evaluate upgrade opportunities, understand constraints, and move forward with confidence — without committing to one-time, high-risk solutions. Our role is to provide clarity at the decision stage, so energy improvements can be planned and phased in a way that aligns with long-term property goals.

What You Get : Roadmap, Not Just a Report

Energy Assessments

Energy assessments that support upgrade planning by identifying current system performance, efficiency considerations, and potential improvement areas for residential and small multi-unit properties.

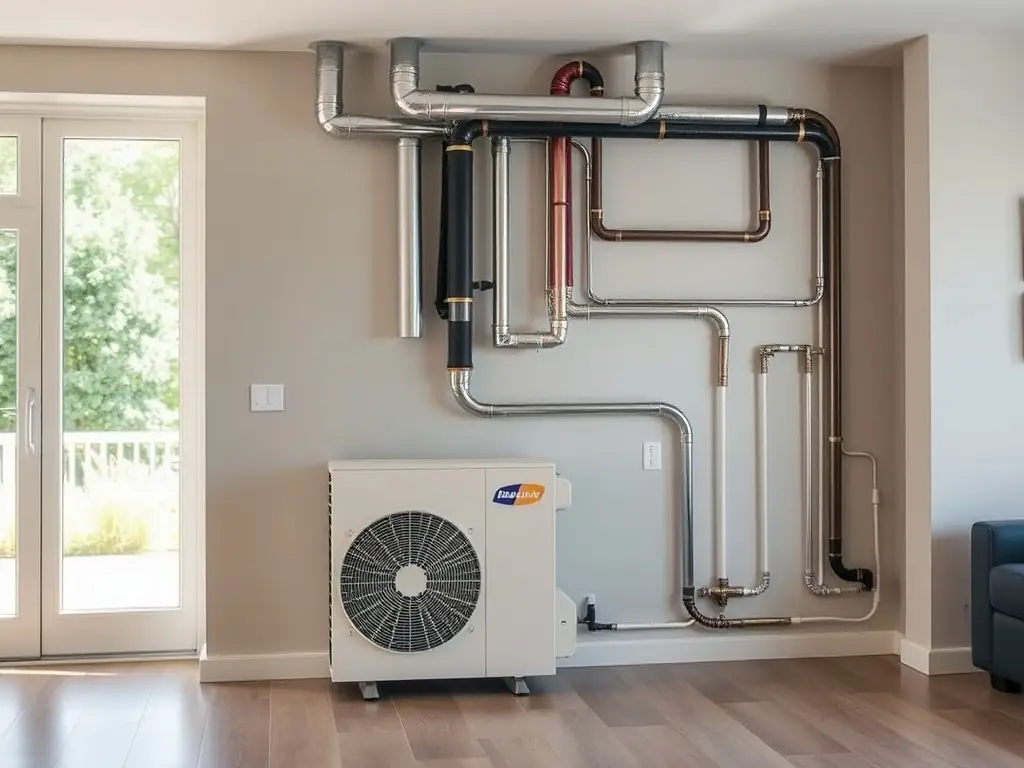

Mechanical Upgrade Considerations

Support in reviewing mechanical system upgrade considerations, including heating and cooling technologies, as part of an overall energy improvement discussion.

On-Site Energy Considerations

Initial discussion of on-site energy options, such as solar or battery storage, where applicable to the building type and project stage.

— PROGRAM COMPLIANCE & FUNDING STRUCTURE

Program-Ready Financing & Incentives

For building owners and asset managers, incentives are not a marketing decision — they are a compliance exercise. Eligibility depends on building type, ownership structure, scope definition, sequencing, and verification — not simply on equipment selection. Our role is to structure energy upgrade projects so they are program-ready from planning through close-out.

Applicable to: Small Business & Multi-Unit Buildings

Performance-based incentives delivered through the IESO Custom Program for small business and eligible multi-unit buildings.

We support program-ready project structuring by defining baselines, coordinating approved energy modelling, and managing pre-approval, verification, and reporting requirements.

Save on Energy :

Small Business & Multi-Unit Buildings

Applicable to: Qualifying Commercial & Multi-Unit Assets

A federal tax and compliance program applicable to qualifying clean technology capital investments.

We support ITC-aligned planning by identifying eligible components, separating qualifying capital costs, and coordinating documentation with owners and tax advisors.

Federal — Clean Technology Investment Tax Credit (ITC)

Applicable to: Residential · Oil-Heated Properties (Ontario)

Ontario offers targeted residential programs for oil-heated homes, including the Home Renovation Savings (HRS) framework and the federal Oil to Heat Pump Affordability Program (OHPA).

These programs are eligibility- and sequence-driven.

We support oil-heated households and rural residential properties by structuring compliant upgrade scopes, coordinating audits, and aligning HRS and OHPA requirements within a single, program-ready pathway.

Oil Heating Residential Programs

Applicable to: Affordable & Rental Housing Assets

Funding for affordable and rental housing is tied to building classification, operating structure, and long-term performance commitments.

We align energy upgrade scopes with housing-linked funding frameworks, including CMHC-related programs, municipal initiatives, and long-term operating targets.

Affordable & Rental Housing — Housing-Linked Funding Programs